If you’re a small business owner or a lender, you’ve probably heard of the SBA 504 Program – a loan designed to help small business owners start, grow, or expand their business. But what exactly does this loan program entail, how can it be used, and what advantages does it offer current and aspiring entrepreneurs?

We’re here to give you the 411 on the 504 and all that it can do to help small business owners throughout their business journey.

SBA 504 Quick Facts:

The SBA 504 program was established by the U.S. Small Business Administration and is named after Section 504 of the Small Business Investment Act of 1958, where it was originally created.

The goal of the program is to promote economic development and retain quality jobs through the financing of long-term, fixed assets (commonly including real estate or equipment) at a fixed, below-market rate.

Great Lakes Commercial Finance (GLCF) is licensed by the U.S. Small Business Administration (SBA) as a Certified Development Company (CDC) to offer the SBA 504 Loan Program throughout the entire state of Michigan.

SBA 504 Loan Structure:

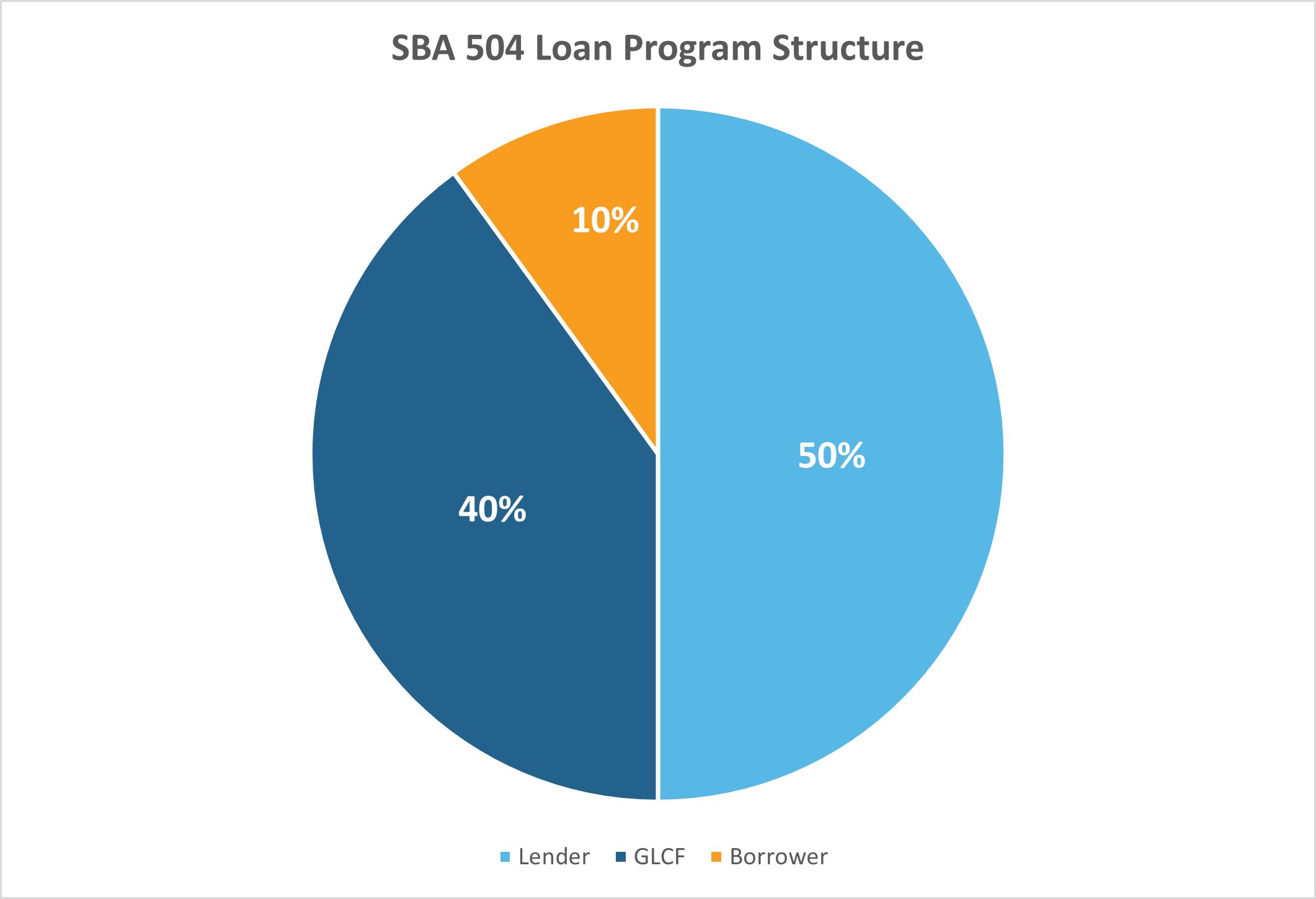

SBA 504 loans are typically structured 50-40-10 and work with three individual parties:

- Bank or Credit Union (50%)

- SBA (GLCF) (40%)

- Borrower (10%)

Structures may vary based on eligibility, use, and business needs

Eligible Uses:

For-profit corporations, LLCs, partnerships, or sole proprietorships that meet the “small business size standards” are eligible for the 504 program. SBA 504 loans can be used for long-term, fixed assets, including:

Benefits to Small Business Owners:

- Less cash up front – Because of this unique 50-40-10 structure, SBA 504 borrowers can finance up to 90% of their total project costs from sources outside of their own pocket (structure may vary depending on eligibility criteria).

- Improved cash flow – The SBA 504’s 10, 20, or 25 year terms are longer than conventional financing options, giving borrowers the opportunity to spread out their payments and increase their cash flow for day-to-day operations.

- Below-market, fixed rates – Interest rates for the SBA 504 loan program at a below-market rate. These rates will remain fixed throughout the duration of the loan, saving borrowers thousands of dollars compared to conventional loan programs.

- Real Estate and Equipment – While loan term selection depends on the needs of the individual business, a longer maturity means lower monthly payments and improved cash flow. The 504 loan also will allow us to finance the purchase of real estate and equipment in one loan using a 10, 20 or 25 year term.

BONUS Opportunity:

SBA 504 Debt Refinance – The SBA 504 Debt Refinance program is a great long-term, fixed rate financing option. This program allows borrowers to restructure their existing debt and take cash out for eligible business expenses

For more info about the SBA 504 program, visit www.glcf.org/loan-programs/504-loan or download our flyer below.

Download our Flyer