Dear Lending Partners: Recent developments on Capitol Hill have increased the likelihood of a short-term government shutdown. Here’s what you need to know: Key Details: The federal government is currently operating under a continuing resolution (CR) through Friday, January 30, 2026. Senate Democratic leaders have indicated they will not support the current funding package, including Department of Homeland Security …

504 Bills Pass the House

SBA Reopens and GLCF Has Hit the Ground Running

November 13, 2025 The federal government and SBA are officially open for business again, and the Great Lakes Commercial Finance Team is already working to submit applications and move projects forward. With the President’s signature now in place, SBA’s Office of Capital Access has reopened its loan systems. ETRAN is live as of 12:01 a.m. on November 13, and SBA …

Navigating SBA Loan Processing Amid the Government Shutdown

Government Shutdown in Effect – Here’s What You Need to Know October 1, 2025 The federal government has officially shut down as Congress was unable to pass a funding bill in time. While the duration of this shutdown remains uncertain, Great Lakes Commercial Finance (GLCF), a trusted SBA 504 lender with decades of experience supporting small businesses across Michigan, is …

Fortino’s / Sweet Temptations

SBA Announces FY 2026 Loan Fees and Offers New Relief for Manufacturers

The U.S. Small Business Administration (SBA) has issued notices announcing the fees for 504 Loans approved during FY2026, including the upfront guaranty fee and the annual service fee (also known as the “ongoing guaranty fee”). SBA annually sets a combination of the upfront guaranty fee and the annual service fee (also known as the “ongoing guaranty fee”) to cover the estimated …

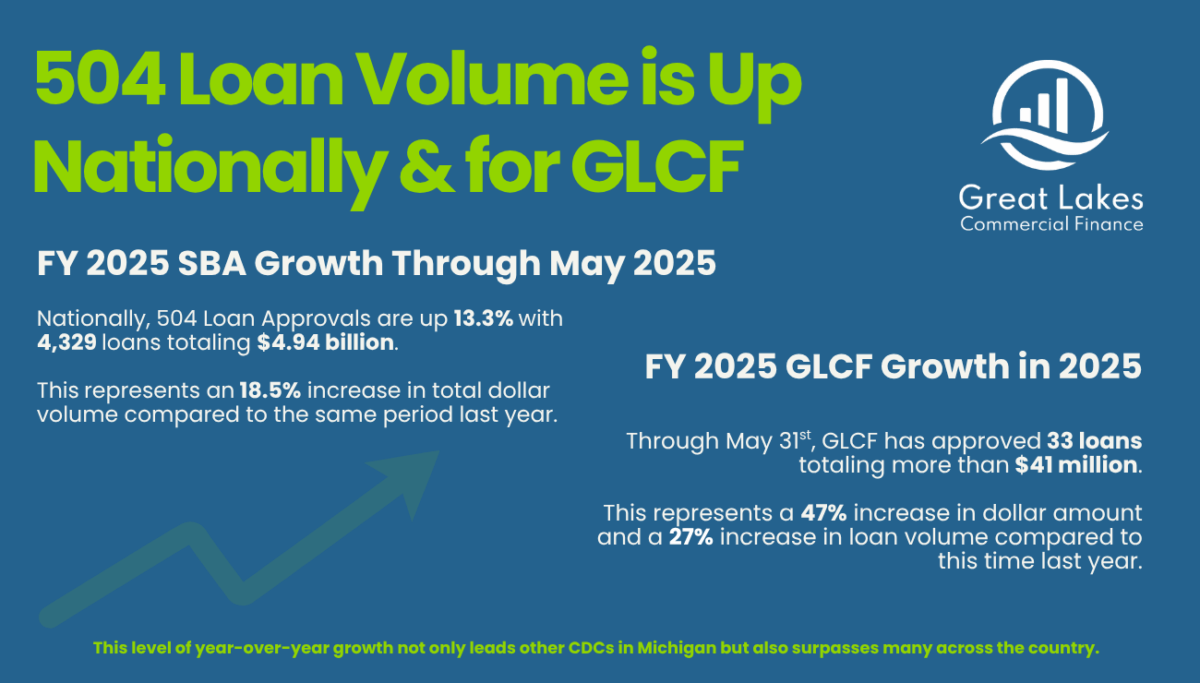

504 Loan Volume is Up Nationally & GLCF is Outpacing the Trend – Why It is a Great Time to Revisit the 504 Loan Program

With interest rates still elevated and credit conditions continuing to tighten, the SBA 504 Loan Program is quickly becoming a preferred option for business owners seeking to invest in real estate or equipment without depleting their critical cash reserves. The most recent SBA data provided to our industry highlights the significant increase in volume. Nationwide, year-to-date SBA 504 approvals for …

Great Lakes Commercial Finance Welcomes Skylar Houchin as Credit Analyst

Great Lakes Commercial Finance (GLCF) is excited to announce that Skylar Houchin has joined the team full-time as a Credit Analyst. Skylar graduated from DePaul University with a degree in Honors Finance and a minor in Economics. He brings a diverse range of experience in wealth management and corporate banking, with expertise in investment research, commercial real estate, asset-backed lending, …